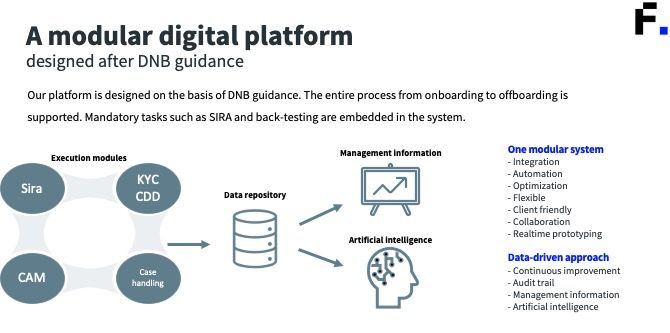

Not surprisingly, Artificial Intelligence is transforming compliance in financial services in a variety of ways. Here are some examples:

1. Improved detection of suspicious activities: AI-powered systems can analyse vast amounts of data to identify suspicious transactions or patterns of behaviour that may indicate financial crimes, such as money laundering or fraud. These systems can learn from past cases and update their algorithms to become more accurate and effective over time.

2. Faster and more accurate regulatory reporting: Compliance requirements in financial services can be complex and time-consuming. AI can automate the process of gathering data and generating reports, reducing the risk of errors and freeing up human resources for other tasks.

3. Enhanced risk management: AI can help financial institutions to better identify and manage risk by analysing data from a wide range of sources, including social media, news articles, and financial reports. This can help institutions to make more informed decisions and reduce their exposure to potential risks.

4. More efficient customer due diligence: Financial institutions are required to conduct customer due diligence to prevent financial crimes. AI can streamline this process by automatically verifying customer identities and assessing their risk level based on factors such as their transaction history and social media activity.

5. Personalised compliance training: AI can help financial institutions to deliver more personalised compliance training to employees. By analysing employees’ learning styles and performance data, AI-powered systems can provide customised training that is more engaging and effective.

How can Fectfinder use AI for detecting Financial Economic Crime?

– by using anomaly detection: AI algoritms can be used to detect anomalous patterns in financial transactions that may indicate fraudulent activity.

– natural language processing: AI-powered software can analyse text data from sources such as emails, chat logs and social media to identify suspicious activity to help identify patterns of language commonly used in financial crimes.

– network analysis: AI algorithms can be used to analyse complex financial networks to identify connections and patterns of behaviour that may indicate fraudulent activity.

– predictive modelling: AI can be used to develop predictive models that identify potential financial crimes before they occur. Of course, these models have to be trained with relevant historical data.

Fectfinder can help your organisation with all these topics. Processes can become more efficient, accurate, and effective, while also reducing false positives and costs and improving customer experience. Very nice indeed, I would say!